AI for Mortgage Brokers:

The Complete Guide

Mortgage brokers are handling more enquiries than ever whilst margins tighten. With a £147 billion remortgage wave approaching as fixed rates expire, brokers who can't efficiently manage their client base will watch revenue walk to competitors.

Trusted by leading UK mortgage brokers

Appointment booking rate on remortgage outreach

Appointments booked automatically

Leads qualified while you sleep

WhatsApp response rate for new enquiries

Why Mortgage Brokers Are Adopting AI

High Enquiry Volumes

Leads from comparison sites, estate agents, website, and introducers - all expecting rapid response.

Instant Response Expected

Modern consumers expect immediate engagement. A 9pm enquiry can't wait until tomorrow morning.

Remortgage Retention

Systematically contacting clients before deal expiry requires time advisors rarely have.

Admin Consuming Advice Time

Fact-finding, qualification, diary management - hours lost that could be spent with clients.

What AI Can Do for Mortgage Brokers

Practical applications available today - not theoretical capabilities, but working solutions deployed in brokerages right now.

Instant Enquiry Response

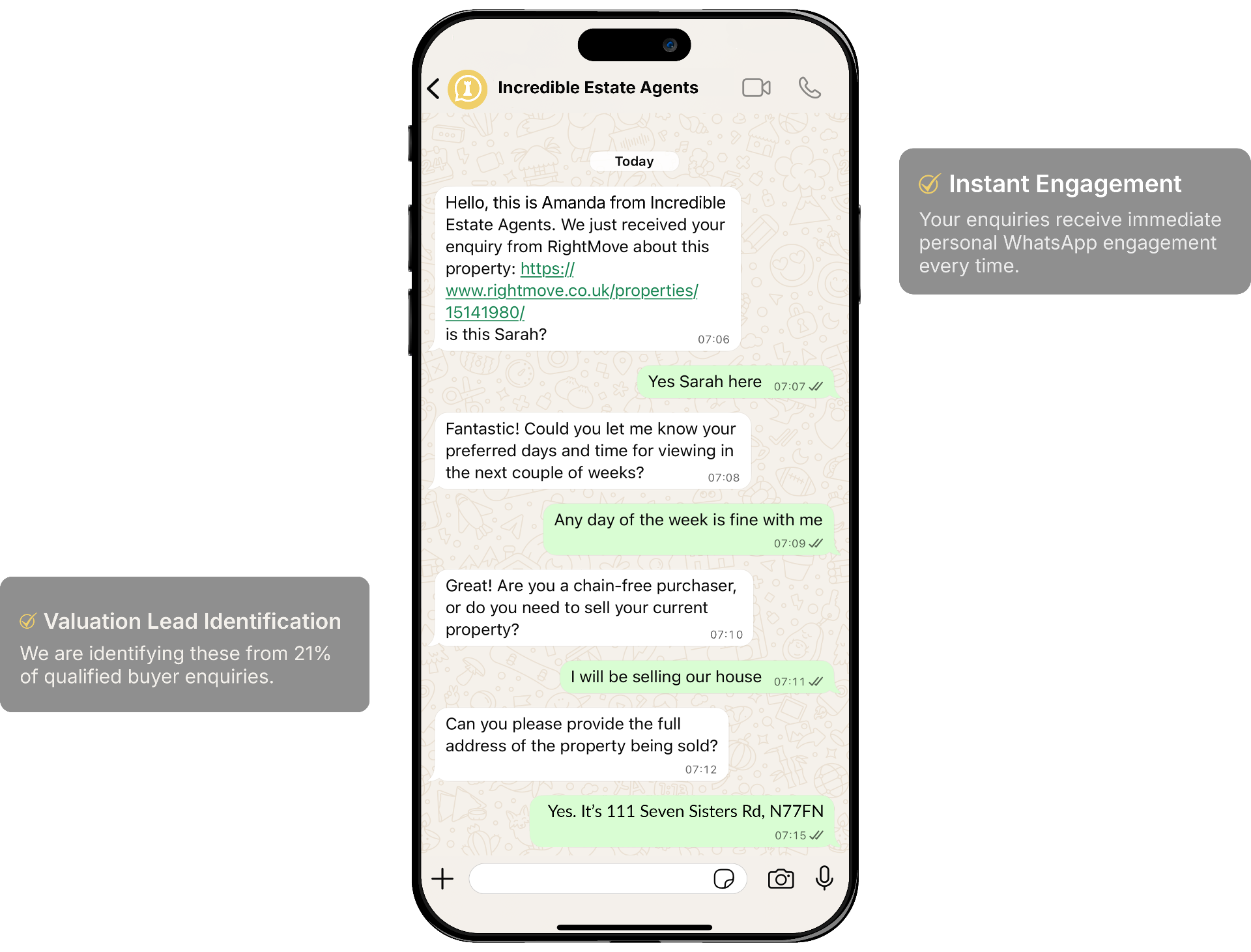

Immediate WhatsApp engagement while interest is at its peak. First broker to engage often wins the business.

Automated Pre-Qualification

Capture employment status, income, deposit, credit history through natural conversation before advisor contact.

Remortgage Pipeline Automation

Proactive WhatsApp outreach to clients approaching deal expiry. 25%+ response and booking rates.

Diary Management

AI books appointments directly into advisor diaries. Automated reminders reduce no-shows and keep your pipeline moving efficiently.

Instant Introducer Lead Response

Engage leads from estate agents and property developers instantly via WhatsApp. Automated handoff ensures no lead goes cold.

Referral Partner Feedback Automation

Keep introducers informed on lead progress automatically. No manual chasing required - partners stay happy and keep referring.

How Leading Brokers Are Using AI

Heron Financial, a full-service mortgage broker since 2011, implemented AI across both new enquiry handling and remortgage pipeline management.

"Clients Think She's a Real Person"

Matt Coulson, Heron Financial

"We're often seeing examples of a client making an enquiry at 10pm at night, with Lily then making that first contact shortly afterwards, and our advisors subsequently coming into the office the next morning with an appointment in their diary and a mini fact-find completed."

Matt Coulson

Founder, Heron Financial

Response and booking rate

Evening engagement

How to Choose AI Software for Your Brokerage

Mortgage-specific qualification flows

Purpose-built solutions understand LTV, affordability, and the specific information advisors need.

WhatsApp capability

WhatsApp delivers 90%+ open rates. Ensure your platform supports WhatsApp Business API.

CRM and back-office integration

If AI doesn't flow into existing systems, you're creating duplicate work rather than eliminating it.

Compliance considerations

Clear audit trails of all communications matter. AI handles engagement, not regulated advice.

Remortgage pipeline features

Prioritise platforms with client database integration, timing-based triggers, and campaign management.

UK data hosting and GDPR compliance

Client financial information requires appropriate protection. Verify compliant data handling.

SalesRook: AI Built for Mortgage Brokers

SalesRook's WhatsApp-first platform handles new enquiry qualification and remortgage pipeline management. Integration with broker networks ensures smooth workflow integration.

WhatsApp-first approach with 90%+ open rates

Remortgage pipeline automation with 25%+ booking rates

Integration with broker networks including MAB affiliates

Mini fact-finds delivered to advisors before first contact

Unlock Mortgage Referrals from Estate Agents

SalesRook offers mortgage brokers a unique competitive advantage when pitching for exclusive introducer partnerships with estate agencies.

Here's how it works: you finance the SalesRook implementation within a partner estate agency. In return, you become their exclusive mortgage introducer. Not just offering commission, but genuine operational value.

The estate agent benefits from SalesRook's full platform, including instant lead engagement, valuation discovery, and 24/7 response. Meanwhile, you gain automated, qualified mortgage referrals from every relevant conversation.

It's a partnership model that differentiates you from every other broker simply offering a referral fee.

How UK Mortgage Brokers Are Using WhatsApp to Navigate the £94 Billion Remortgage Wave

When I talk to mortgage brokers about the next six months, the first reaction is almost always anxiety. Then comes excitement, once they realise there's actually a solution.

Read the Full ArticleFrequently Asked Questions

The technology actually strengthens compliance by capturing every client interaction with timestamped audit trails, ensuring consistent information gathering, and documenting the clear handoff point between AI qualification and human advice.

Read our full guide to FCA compliance for AI in mortgage broking →

Most brokerages see ROI within weeks through improved conversion rates, reduced admin time, and the ability to capture leads 24/7 without additional headcount. Mortgage broker implementations can vary significantly based on your existing systems and workflows.

View pricing overview → · Book a strategy session →

We're currently working with mortgage broker partners to automate outreach to clients who've recently completed mortgages, engaging them on protection cover at exactly the right moment. It's a natural extension that helps you capture more value from existing client relationships.

Book a strategy session →

As Featured In

See AI in Action for Your Brokerage

The brokers thriving through market cycles aren't necessarily the largest. They're the ones who've built efficient operations that convert enquiries reliably and retain existing clients systematically.